How to Start a Nonprofit in 10 Steps

Posted by Clash Printing Atlanta on 23rd Oct 2024

Ready to turn your passion into a mission-driven nonprofit? This clashgraphics.com guide on how to start a nonprofit offers clear, actionable steps—from understanding nonprofit basics to securing tax-exempt status. Follow along to learn how to form a board, draft bylaws, and more. Let's get started on making a difference.

Key Takeaways

-

Understanding the fundamentals of a nonprofit is key, as well as focusing on community service rather than profit generation.

-

Thorough research and validation of your nonprofit idea aligned with community needs, sets a solid foundation for its mission.

-

Establishing strong financial systems and ongoing compliance ensures sustainability and builds trust with donors and regulatory bodies.

Understand What a Nonprofit Is

A nonprofit organization operates primarily for charitable or socially beneficial purposes rather than generating profit. Unlike for-profit companies, nonprofit organizations are designed to serve the community or advance a specific social cause. This fundamental difference shapes charitable organizations' operations and defines their impact on society.

One of the key characteristics of nonprofits is that they cannot distribute profits to individuals; all earnings must further the organization's mission. For example, if a nonprofit generates revenue through fundraising events or donations, the money must be used to support its programs and initiatives rather than being distributed to shareholders. This ensures that the nonprofit's mission remains at the forefront of all its activities.

Nonprofits often focus on causes like education, health, or community welfare. They rely on diverse funding sources, such as donations, grants, and fundraising events, to support their activities. Contributions to nonprofits are typically tax-deductible for donors, providing an added incentive for public support. This tax-exempt status is a significant advantage, but it also comes with the responsibility of ensuring that the nonprofit complies with various regulations and reporting requirements.

Understanding these foundational aspects is crucial for anyone looking to start a nonprofit. By recognizing the unique characteristics and operational requirements of nonprofit organizations, you can better align your vision with the realities of running a successful nonprofit.

1. Research and Validate Your Nonprofit Idea

Before diving into the formalities of starting a nonprofit, it's essential to research and validate your nonprofit idea. This step ensures that your vision aligns with the community's actual needs and increases the chances of creating a successful nonprofit organization.

Utilizing surveys and questionnaires can provide valuable insights into community perceptions and needs for a nonprofit's services. Engaging with community members through focus groups can yield in-depth feedback on your proposed programs. These methods help understand the specific issues your nonprofit aims to address and how charitable organizations operate within the community.

Conducting community forums allows you to foster dialogue and gather diverse opinions on local needs and solutions. Direct observation in community spaces can uncover needs that residents may not explicitly recognize, providing qualitative insights. Combining these approaches helps create a thorough community needs assessment, identifying service gaps and shaping programs to meet demands.

Compiling and analyzing data from various sources can help you identify key strengths and weaknesses in community services. By analyzing demographic changes, you can adapt your strategies to address evolving community needs. Your community needs assessment results should culminate in a clear action plan outlining priorities and strategies for addressing identified gaps. This thorough research and validation process lays a solid foundation for your nonprofit's mission and ensures that your efforts are both needed and appreciated by the community.

2. Develop a Solid Business Plan

Developing a solid business plan is a crucial step in starting a nonprofit. A nonprofit business plan serves as a guiding document detailing the organization's goals and how to achieve them. It acts as a blueprint for how the nonprofit will operate and provides a clear roadmap for its future.

The executive summary is a critical component of the business plan. It encapsulates the nonprofit's mission, background, strengths, and key plans. This section should clearly articulate your vision and explain how your nonprofit's services will address community needs. A well-crafted executive summary can attract potential supporters and funders by providing a compelling overview of your nonprofit's goals and strategies.

A financial plan is equally important. It outlines your nonprofit's budget, funding sources, and financial management strategies. This section is crucial for obtaining donations, applying for grants, and managing the budget efficiently. Financial management involves strategic planning to ensure sustainable financial health, and supporters may request to see the business plan before deciding to fund the organization.

Common reasons for nonprofits to fail from the start include a lack of research and planning. Therefore, it's essential to do sufficient research and planning to maximize your chances of success. A comprehensive business plan lays a solid foundation and provides a clear strategy for achieving your nonprofit's goals.

3. Form Your Board of Directors

Forming a board of directors is a critical step in establishing a nonprofit. A founding board is crucial for setting the nonprofit's vision and initiating its operations. The board plays a vital role in governance, strategic planning, and ensuring the organization stays true to its mission.

Recruiting a diverse board with various skills is essential to serve the communities the nonprofit aims to impact effectively. Your board should be made up of individuals with expertise and resources in different areas. Actively involving board members in defining their roles and responsibilities from the onset can lead to more effective governance and engagement.

Board members typically include roles such as President, Secretary, and Treasurer. It's important to have a governance committee that focuses on training new board members. Essential training should include a comprehensive orientation program to ensure that all board members understand their roles and responsibilities, including how many board members are necessary for effective governance.

The first board meetings are significant for formalizing the board's existence, including electing officers and adopting bylaws. Leveraging personal networks and community organizations helps find suitable board candidates. This step ensures that your nonprofit has a strong leadership team from the very beginning, setting the stage for effective governance and successful operations.

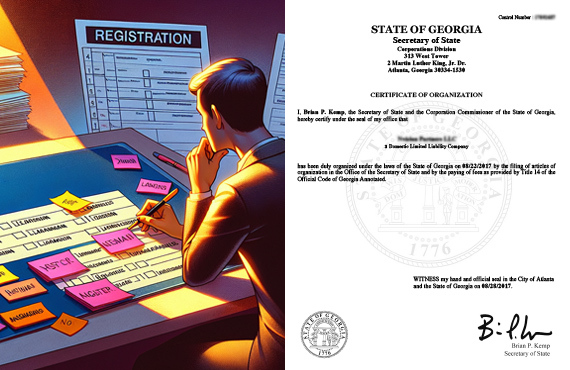

4. Choose a Name and Register Your Nonprofit

Choosing the right name for your nonprofit is more than just a formality; it serves as the first impression for potential supporters and should clearly reflect your mission. A unique name can pique curiosity and differentiate your organization from others. It's critical to ensure your chosen name is not already trademarked to avoid legal complications.

Before finalizing your nonprofit name, check the availability of the desired website domain and social media handles. This step is essential to ensure consistent branding across all platforms. Once you have a name, the next step is to register your nonprofit organization.

To register your nonprofit, you must provide details such as the name, directors, incorporator, and registered agent in your application. This process includes filing articles of incorporation, which formalizes your nonprofit's existence and allows you to start operating legally. Carefully choosing and registering your nonprofit's name sets the stage for effective branding and legal compliance.

5. Draft and Adopt Bylaws

Bylaws serve as the operational manual for nonprofit organizations, outlining how the board will function and the roles of its members. These documents are crucial for guiding decision-making within the board and ensuring effective governance. Drafting comprehensive bylaws is a key step in starting a nonprofit.

Nonprofit bylaws must include the organization's name, board of directors, board meeting procedures, and a conflict of interest clause. They should also outline protocols for meetings, the election of directors, and the appointment of officers to ensure clear governance. Legal expertise is needed to create and finalize bylaws, ensuring they function as intended and comply with regulations.

At the first board meeting, it is important to review and approve both the conflict of interest policy and the bylaws. A conflict of interest policy is required to protect leadership and ensure governance within the nonprofit's operations. A conflict of interest policy should be developed following the creation of the bylaws to ensure cohesive governance.

Adopting well-drafted bylaws establishes a strong framework for your nonprofit's operations and governance.

6. Obtain an Employer Identification Number (EIN)

Every nonprofit organization requires an Employer Identification Number (EIN), even if it does not employ staff. An EIN is necessary for a nonprofit to hire staff, open a bank account, and complete necessary registration forms. To get an EIN, you can visit the IRS website and complete the application online. Alternatively, you can download the form and mail it in.

When applying for an EIN, it's important to indicate your organization type as either a church or a nonprofit. Organizations should only apply for an EIN after they have been legally established.

Important information needed for an EIN application includes the physical mailing address, the legal name of the nonprofit, and your Social Security Number. Securing an EIN ensures your nonprofit can operate legally and manage its finances effectively.

7. Apply for Federal Tax Exempt Status

Obtaining federal tax-exempt status is a crucial step for any nonprofit. To apply for 501(c)(3) status, organizations must submit Form 1023 or the expedited Form 1023-EZ. The filing fee for Form 1023 is $600, and the processing time can range from 3 to 12 months, while Form 1023-EZ takes about 2-4 weeks. This application process confirms that the organization is formed exclusively for 501(c)(3) purposes.

One of the significant benefits of obtaining 501(c)(3) status is that it provides tax exemption for nonprofits and eliminates federal income tax obligations. Charitable organizations associated with 501(c)(3) status are eligible for public and private grants. This status also makes donations to your nonprofit tax-deductible for donors, encouraging more contributions.

Including bylaws in the IRS application is important when applying for 501(c)(3) status. After receiving 501(c)(3) status, organizations may need to submit a copy of their IRS exemption letter when applying for state tax exemptions.

Common reasons for denial of a 501(c)(3) application include conflicts of interest and improper benefits to insiders. There are different charities and exempt nonprofit types, so carefully following the application process and addressing potential pitfalls secures federal tax-exempt status and sets your nonprofit on the path to success.

8. Secure State Tax Exemptions

After obtaining federal tax-exempt status, it's essential to secure state tax exemptions. Most states require nonprofits to apply for state tax exemptions in their respective states after achieving federal recognition of their 501(c)(3) status. This process is crucial for nonprofits to operate financially and to attract donations.

The review process for state tax exemption applications can vary significantly by state, with some states evaluating requests on a case-by-case basis. Some states may require nonprofits to include specific forms with their exemption applications. In many cases, nonprofits must submit their founding documents along with their exemption request.

Once state tax exemption is granted, the approved application must be made available for public inspection along with any supporting documents. This transparency helps build trust with donors and the public. Securing state tax-exempt status allows your nonprofit to fully benefit from tax-exempt status and maximize its financial resources.

9. Establish Financial Systems and Open a Bank Account

Establishing robust financial systems is crucial for the smooth operation of any nonprofit. Developing clear financial policies is essential for guiding day-to-day financial operations within a nonprofit. These policies help ensure transparency, accountability, and efficient management of the nonprofit's financial resources.

A chart of accounts organizes a nonprofit's financial data and is essential for proper nonprofit accounting practices. Utilizing accounting software can streamline financial data management, making tracking donations, expenses, and grants easier. This ensures the nonprofit complies with reporting requirements and maintains accurate financial records.

For small nonprofits, outsourcing financial management can be a cost-effective way to access professional financial expertise. This allows the nonprofit to focus on its mission while ensuring its finances are managed effectively. Whether managed internally or outsourced, having a Chief Financial Officer or equivalent role is critical for overseeing financial operations and ensuring compliance.

Once your financial systems are in place, the next step is to open a bank account. This allows your nonprofit to manage its funds, accept donations, and pay for expenses. Establishing strong financial systems and opening a dedicated bank account lay the groundwork for financial stability and transparency.

10. Ongoing Compliance and Reporting

Maintaining ongoing compliance and reporting is vital for the sustainability of a nonprofit. Nonprofits are required to file Form 990 with the IRS, providing detailed financial information. Annual tax returns must be submitted to the IRS, with specific forms based on the nonprofit's revenue.

It is essential to update bylaws and report changes to the Internal Revenue Service during annual filings to maintain compliance. Nonprofits must keep detailed financial records to fulfill tax and reporting obligations. You track revenue and expenses. Additionally, you monitor board members, achievements, and operational details.

In addition to federal obligations, nonprofits must adhere to various state regulations concerning registration and reporting. Failure to comply with local, state, and federal requirements can lead to severe consequences, including revoking tax-exempt status after three consecutive years of non-compliance. Nonprofits that fail to submit renewal on time may lose their tax exemption and become personally liable.

Ensuring ongoing compliance and regular reporting maintains your nonprofit's good standing and builds trust with donors, beneficiaries, and regulatory bodies. This commitment to transparency and accountability is crucial for the long-term success of your nonprofit.

Summary of How to Start a Non-Profit

Starting a charity or nonprofit is a multifaceted process that requires careful planning, dedication, and a clear understanding of various legal and operational requirements. From understanding the fundamental nature of nonprofits to securing tax exemptions and ensuring ongoing compliance, each step is crucial in building a successful and impactful organization.

By following this 10-step guide, you can confidently navigate the complexities of starting a nonprofit. The journey may be challenging, but the reward of making a positive difference in your community is immeasurable. Embrace the process, stay committed to your mission, and your nonprofit will become a powerful force for good.

Starting a NonProfit Frequently Asked Questions

How to start a nonprofit organization?

Starting a nonprofit organization involves a few essential steps: incorporate your nonprofit, secure an EIN, elect a board of directors, and apply for tax-exempt status. Once these are in place, you can focus on developing your mission and fundraising!

How much money should you have to start a nonprofit?

You should plan to have at least a few thousand dollars to start a nonprofit, with around $1,000 just for government fees. Don't forget to factor in costs for software, a website, and initial marketing efforts!

How do you start a nonprofit with no money?

You can start a nonprofit with no money by creating a solid business plan, building a passionate board and team, and leveraging free online fundraising tools. Remember to seek community grants and consider fiscal sponsors to support your vision!

What is the primary purpose of a nonprofit organization?

The primary purpose of a nonprofit organization is to serve the community or advance a social cause rather than making a profit. They focus on important areas like education, health, and community welfare.

Why is it important to conduct a community needs assessment before starting a nonprofit?

Conducting a community needs assessment is crucial because it allows you to pinpoint the specific gaps in services and tailor your nonprofit's programs accordingly, boosting your chances of success. Understanding the community's true needs ensures your efforts will have the most impact.

(678) 235-3464